Dive into the world of hedge funds for beginners where the financial game gets real. From unraveling the mysteries of investment strategies to navigating the risks and rewards, this guide will equip you with the knowledge to kickstart your journey into the world of high-stakes finance.

Overview of Hedge Funds

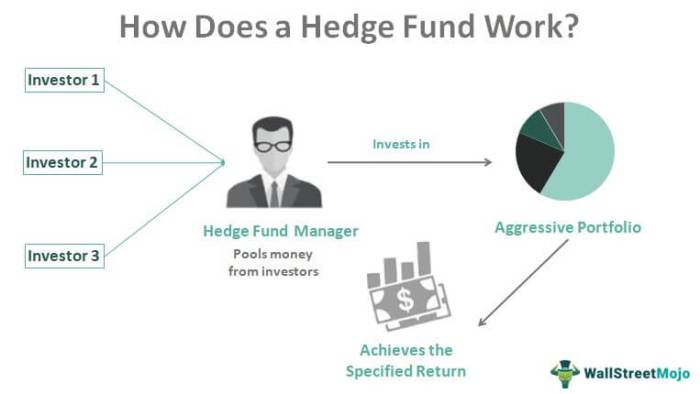

Hedge funds are alternative investment funds that aim to generate high returns for their investors using a variety of strategies that may not be available to traditional investment funds. Unlike mutual funds, hedge funds typically have a more flexible investment approach and can invest in a wider range of assets, such as stocks, bonds, commodities, and derivatives.

Strategies Used by Hedge Funds

- Long/Short Equity: Hedge funds can take both long (buy) and short (sell) positions in stocks to profit from both rising and falling prices.

- Arbitrage: Hedge funds exploit price inefficiencies in the market by simultaneously buying and selling related assets to lock in profits.

- Event-Driven: Hedge funds capitalize on corporate events such as mergers, acquisitions, bankruptcies, or restructurings to generate returns.

Characteristics of Hedge Funds

- High Minimum Investment Requirements: Hedge funds typically require a significant initial investment, making them accessible only to accredited investors.

- Limited Regulatory Oversight: Compared to mutual funds, hedge funds face less regulatory scrutiny, allowing them more flexibility in their investment strategies.

- Performance Fees: Hedge fund managers often charge a performance fee in addition to a management fee, based on the fund’s returns exceeding a certain benchmark.

Benefits of Investing in Hedge Funds

Investing in hedge funds can offer several advantages for investors looking to diversify their portfolios and potentially achieve higher returns. Hedge funds are actively managed investment vehicles that can provide access to specialized markets and strategies not typically available through traditional investment options like mutual funds or ETFs.

Diversification and Potential for Higher Returns

Investing in hedge funds can help investors diversify their portfolios by gaining exposure to a wide range of asset classes, including stocks, bonds, currencies, and commodities. This diversification can help reduce risk and protect against market downturns. Additionally, hedge funds often have the flexibility to use leverage and short-selling strategies, which can potentially lead to higher returns compared to traditional investments.

Comparison with Other Investment Options

When comparing the performance of hedge funds with other investment options like mutual funds or ETFs, hedge funds have the potential to outperform due to their active management strategies. While mutual funds and ETFs may track specific indexes or benchmarks, hedge funds can actively seek out opportunities for alpha generation through various trading strategies.

Access to Specialized Markets and Strategies

One of the key benefits of investing in hedge funds is the ability to access specialized markets or strategies that are not easily accessible through traditional investment vehicles. Hedge funds can invest in alternative assets like private equity, real estate, or distressed debt, providing investors with unique opportunities for diversification and potential higher returns.

Risks Associated with Hedge Funds

Investing in hedge funds comes with its fair share of risks that investors should be aware of. These risks can impact the performance and returns of the fund, so it’s essential to understand them before diving in.

Lack of Liquidity and High Fees

One of the main risks associated with hedge funds is the lack of liquidity. Unlike traditional investments like stocks or bonds, hedge funds often have lock-up periods where investors cannot easily access their funds. Additionally, hedge funds typically charge high fees, including management fees and performance fees, which can eat into potential profits.

Impact of Leverage and Derivatives

Hedge funds often use leverage and derivatives to amplify their returns. While this can lead to higher profits in a good market, it also increases the risk of significant losses. The use of complex financial instruments like derivatives can expose the fund to unforeseen risks and volatility.

Regulatory Changes and Market Conditions

Changes in regulations or shifts in market conditions can also pose risks to hedge fund investments. Regulatory changes can affect the fund’s operations and profitability, while unfavorable market conditions can lead to poor performance. It’s crucial for investors to stay informed about these external factors that can impact their hedge fund investments.

How to Invest in Hedge Funds

Investing in hedge funds can be a complex process that requires careful consideration and research. Here are the steps you need to take to invest in hedge funds successfully:

Finding a Suitable Fund

- Research different hedge funds to find one that aligns with your investment goals and risk tolerance.

- Consider factors such as the fund’s investment strategy, track record, and reputation.

- Consult with a financial advisor to get guidance on selecting the right fund for you.

Meeting Investment Requirements

- Determine the minimum investment amount required by the hedge fund you are interested in.

- Ensure you meet the fund’s accreditation criteria, as many hedge funds are only open to accredited investors.

- Complete the necessary paperwork and comply with any legal or regulatory requirements.

Fee Structures and Impact on Returns

Before investing in a hedge fund, it’s crucial to understand the different fee structures commonly used by these funds. The two main fees that can impact investor returns are:

- Management Fees: Charged as a percentage of assets under management, typically ranging from 1% to 2% annually.

- Performance Fees: Also known as incentive fees, these are a percentage of the fund’s profits, usually around 20%.

It’s essential to consider how these fees will affect your overall returns and to compare fee structures across different funds to make an informed decision.

Due Diligence and Research

- Conduct thorough due diligence on the hedge fund, including reviewing its track record, investment strategy, and risk management practices.

- Research the fund manager’s background and experience in managing similar funds.

- Seek advice from financial experts or consultants to ensure you are making a well-informed investment decision.