Get ready to dive into the dynamic world of financial technology with a fresh perspective on the latest trends that are revolutionizing the industry. From AI integration to blockchain advancements, this overview will keep you hooked with its insightful analysis and real-world applications.

Delve deeper into the key areas where fintech is reshaping traditional banking and financial services, providing a comprehensive understanding of the evolving landscape.

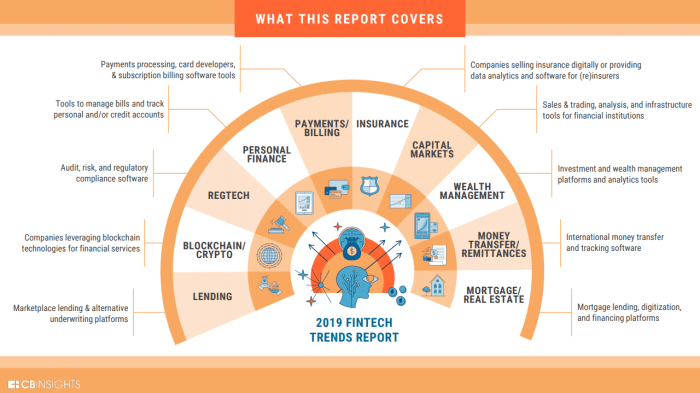

Overview of Fintech Trends

Fintech, short for financial technology, is revolutionizing the way we handle money and conduct transactions. With advancements in digital technology, fintech has been rapidly evolving and shaping the financial landscape.

Mobile Payments

Mobile payments have gained popularity as more people opt for convenient and secure ways to make transactions. With the rise of mobile wallets and apps, traditional cash payments are becoming less common.

Blockchain Technology

Blockchain technology is disrupting the financial sector by providing secure and transparent transactions. Cryptocurrencies like Bitcoin are gaining acceptance, and blockchain is being explored for various applications beyond just digital currencies.

Artificial Intelligence in Banking

Artificial intelligence is being utilized by banks and financial institutions to enhance customer service, automate processes, and detect fraud. Chatbots and robo-advisors are examples of AI applications in the financial industry.

Big Data Analytics

Big data analytics is helping financial companies make better decisions by analyzing large volumes of data to identify trends and patterns. This enables personalized services and more accurate risk assessments.

Regtech Solutions

Regtech, or regulatory technology, is helping financial firms comply with regulations more efficiently. These solutions use technology to streamline compliance processes and ensure adherence to complex financial laws.

Impact on Traditional Banking

The rise of fintech is challenging traditional banking institutions to adapt and innovate. Banks are now investing in technology to stay competitive and meet the changing expectations of customers who are increasingly turning to fintech solutions.

Artificial Intelligence in Fintech

Artificial intelligence (AI) is revolutionizing the financial technology (fintech) industry by enabling advanced data analysis, automation, and personalized services. By leveraging AI technologies, fintech companies can enhance their offerings, improve customer experiences, and streamline operations.

Fraud Detection

AI plays a crucial role in fraud detection within fintech. Machine learning algorithms can analyze vast amounts of transaction data in real-time to identify patterns and anomalies that may indicate fraudulent activities. By detecting fraudulent behavior early, AI helps prevent financial losses and protects both businesses and consumers.

Customer Service

AI-powered chatbots and virtual assistants are transforming customer service in fintech. These intelligent systems can provide personalized recommendations, answer inquiries, and resolve issues efficiently. By incorporating natural language processing and machine learning, fintech companies can deliver seamless and responsive customer support, enhancing overall satisfaction.

Benefits and Challenges

- Benefits:

- Improved Efficiency: AI automates repetitive tasks, streamlining processes and reducing human error.

- Enhanced Personalization: AI enables tailored financial recommendations based on individual preferences and behavior.

- Risk Management: AI algorithms can assess risks in real-time and provide insights for better decision-making.

- Challenges:

- Data Privacy Concerns: AI relies on vast amounts of data, raising questions about privacy and security.

- Algorithm Bias: Unintentional biases in AI models can lead to unfair outcomes or discrimination.

- Regulatory Compliance: Fintech companies must navigate complex regulatory frameworks when implementing AI solutions.

Blockchain and Cryptocurrency

Blockchain technology has been a game-changer in the fintech industry, revolutionizing the way transactions are conducted. By creating a decentralized and secure ledger system, blockchain has increased transparency, reduced costs, and enhanced efficiency in financial services.

Cryptocurrencies, such as Bitcoin and Ethereum, have disrupted the traditional financial landscape by offering an alternative digital form of money. These digital currencies enable peer-to-peer transactions without the need for intermediaries like banks or payment processors. Cryptocurrencies have also paved the way for new business models and investment opportunities.

Different Blockchain Platforms

- Bitcoin: The first and most well-known blockchain platform, Bitcoin is primarily used as a digital currency for peer-to-peer transactions.

- Ethereum: Known for its smart contract capabilities, Ethereum allows developers to create decentralized applications (dApps) on its blockchain.

- Ripple: Focused on facilitating cross-border payments, Ripple’s blockchain platform aims to streamline international money transfers.

Mobile Payments and Digital Wallets

Mobile payments and digital wallets have revolutionized the way we handle transactions in today’s fast-paced world. With the convenience of making payments with just a tap on our smartphones, these fintech solutions have gained immense popularity.

Growth of Mobile Payments

- Mobile payments have experienced exponential growth in recent years, with more and more consumers opting for the convenience of paying through their mobile devices.

- Companies like Apple Pay, Google Pay, and Samsung Pay have become household names, offering secure and seamless payment options to users.

- The rise of e-commerce and online shopping has further fueled the growth of mobile payments, as consumers seek quick and easy ways to complete their purchases.

Security Measures in Digital Payment Systems

- Digital payment systems employ advanced security measures such as encryption, tokenization, and biometric authentication to ensure the safety of transactions.

- Two-factor authentication and fraud detection algorithms help in preventing unauthorized access and fraudulent activities within digital wallets.

- Regulatory bodies and industry standards play a crucial role in setting guidelines for data protection and security in digital payment systems.

Adoption Rates of Mobile Payment Solutions

- Mobile payment solutions have been widely adopted in countries like China, where platforms like Alipay and WeChat Pay dominate the market.

- In developed countries, the adoption of mobile payments is steadily increasing, driven by the convenience and speed offered by these digital payment methods.

- Emerging markets are also witnessing a surge in mobile payment usage, as more people gain access to smartphones and internet connectivity.

RegTech and Compliance Solutions

Regulatory technology, or RegTech, plays a crucial role in the operations of financial technology (fintech) companies. It involves the use of technology to help financial institutions comply with regulations efficiently and effectively, ultimately reducing risks and ensuring compliance.

Importance of RegTech

Regulatory compliance is a top priority for financial institutions, as failure to comply with regulations can result in hefty fines and damage to reputation. RegTech solutions help automate compliance processes, monitor transactions for suspicious activities, and ensure that all regulatory requirements are met in a timely manner.

- Automated Reporting: RegTech tools can automate the process of generating and submitting regulatory reports, saving time and reducing the risk of errors.

- Identity Verification: Solutions like biometric authentication and identity verification technologies help financial institutions comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Risk Management: RegTech platforms use data analytics and artificial intelligence to assess and mitigate risks more effectively, helping institutions stay compliant with risk management regulations.

Examples of Compliance Solutions

Financial institutions use a variety of RegTech solutions to streamline compliance processes and ensure adherence to regulations. Some examples include:

- Compliance Monitoring Platforms: These tools help institutions monitor transactions in real-time, flagging any suspicious activities for further investigation.

- Regulatory Reporting Software: Software that automates the generation and submission of regulatory reports to relevant authorities, ensuring accuracy and timeliness.

- AML Screening Tools: Solutions that use algorithms to screen customers and transactions for potential money laundering activities, helping institutions comply with AML regulations.

Streamlining Regulatory Processes

RegTech is revolutionizing the way financial institutions approach regulatory compliance. By leveraging technology and data analytics, RegTech solutions are streamlining regulatory processes, reducing manual work, and improving the overall efficiency of compliance operations. This not only helps institutions save time and resources but also minimizes the risk of non-compliance and associated penalties.

Peer-to-Peer Lending and Crowdfunding

Peer-to-peer lending and crowdfunding are innovative financial solutions that have disrupted traditional lending models and democratized access to capital.

Peer-to-Peer Lending

Peer-to-peer lending, also known as P2P lending, involves individuals lending money to other individuals or small businesses through online platforms. This direct lending bypasses traditional financial institutions like banks, allowing borrowers to access funds at potentially lower interest rates and investors to earn attractive returns.

- Impact on Traditional Lending Models: Peer-to-peer lending has challenged the traditional banking system by providing an alternative source of financing for borrowers who may not qualify for loans from banks. This disintermediation has led to increased competition and greater efficiency in the lending market.

- Risks and Benefits: While peer-to-peer lending offers benefits such as quick access to funds and competitive interest rates, there are risks involved, such as the potential for default by borrowers and lack of regulatory oversight. Investors should carefully assess the risks before participating in P2P lending.

Crowdfunding

Crowdfunding platforms enable individuals or businesses to raise funds from a large number of people, typically through small contributions. This method of financing has gained popularity for various purposes, including startups, creative projects, and charitable causes.

- Growth of Crowdfunding Platforms: Crowdfunding has experienced significant growth, with platforms like Kickstarter and Indiegogo becoming well-known for supporting innovative projects and ideas. This form of alternative financing has democratized the fundraising process and empowered entrepreneurs and creators.

- Role in Fintech: Crowdfunding plays a vital role in fintech by providing a platform for individuals to invest in projects they believe in and contribute to the success of innovative ventures. It has opened up new opportunities for fundraising and investment, disrupting traditional fundraising methods.