Embark on a journey exploring the advantageous realm of a Roth IRA, where financial wisdom meets tax-savvy decisions. Get ready to delve into a world of tax benefits, investment options, and estate planning perks that could shape your financial future.

Introduction to Roth IRA

A Roth IRA is a type of individual retirement account that offers tax-free growth and withdrawals in retirement. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, meaning withdrawals in retirement are tax-free.

Key Features of a Roth IRA

- Contributions are made with after-tax dollars

- Earnings grow tax-free

- Qualified withdrawals are tax-free

- No required minimum distributions during the account owner’s lifetime

Differences from a Traditional IRA

Unlike a traditional IRA where contributions are tax-deductible and withdrawals are taxed in retirement, a Roth IRA offers tax-free withdrawals in retirement after paying taxes on contributions upfront.

Eligibility Criteria for Roth IRA

To open a Roth IRA account, individuals must meet certain income requirements. As of 2021, single filers must have a modified adjusted gross income (MAGI) below $140,000, while married couples filing jointly must have a MAGI below $208,000 to contribute the maximum amount.

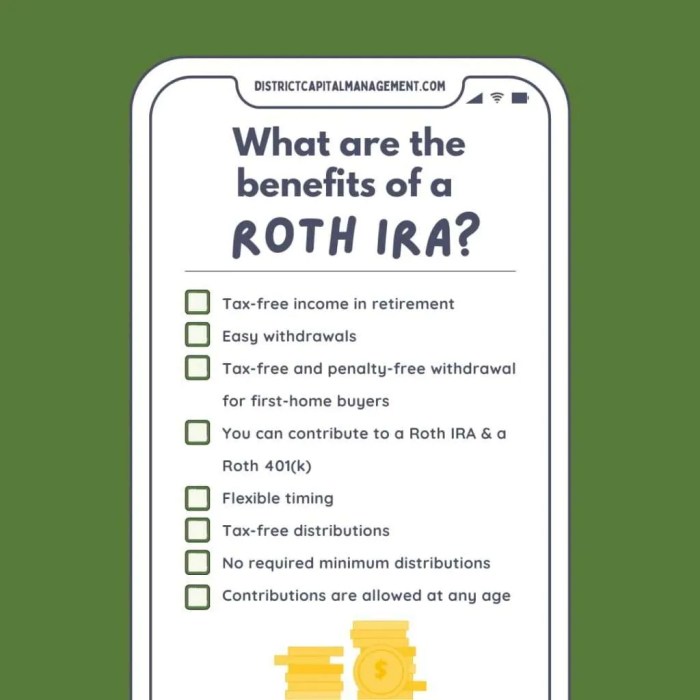

Tax Benefits of a Roth IRA

When it comes to saving for retirement, a Roth IRA offers some fantastic tax advantages that can help you grow your nest egg over time. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you won’t get a tax deduction upfront. However, the real benefits come later down the road.

Tax-Free Growth

One of the biggest perks of a Roth IRA is that your contributions can grow tax-free. This means that any earnings your investments generate within the account are not subject to capital gains taxes. Over time, this can lead to significant savings compared to a taxable investment account.

Withdrawal Tax Implications

When it comes time to take money out of your Roth IRA in retirement, you won’t owe any taxes on qualified withdrawals. This is a major advantage over traditional IRAs, where withdrawals are taxed as ordinary income. By choosing a Roth IRA, you can enjoy tax-free income in retirement, giving you more control over your tax situation.

Investment Options in a Roth IRA

When it comes to investing in a Roth IRA, there are various options available that can help you grow your retirement savings over time. Let’s explore some of the investment options within a Roth IRA and how they can potentially offer higher returns compared to traditional savings accounts.

Stocks

Stocks are a popular investment option within a Roth IRA. By purchasing shares of a company, you are essentially buying a small piece of that company. Stocks have the potential for high returns over the long term, but they also come with higher risk compared to other investment options.

Bonds

Bonds are another investment option available in a Roth IRA. When you invest in bonds, you are essentially lending money to a company or government in exchange for periodic interest payments. Bonds are generally considered less risky than stocks, making them a more conservative investment choice.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Investing in mutual funds within a Roth IRA allows for instant diversification, which can help mitigate risk and potentially increase returns over time.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. Investing in REITs within a Roth IRA provides exposure to the real estate market without the need to directly own physical properties.

Diversification in a Roth IRA

Diversification is key to reducing risk and maximizing returns within a Roth IRA. By investing in a mix of different asset classes such as stocks, bonds, mutual funds, and REITs, you can spread out your risk and potentially achieve more stable long-term growth.

By leveraging the various investment options available within a Roth IRA and diversifying your portfolio, you can potentially maximize your returns while safeguarding your retirement savings for the future.

Withdrawal Rules and Penalties

When it comes to withdrawing funds from a Roth IRA, there are specific rules and penalties to consider. Let’s dive into the details.

Early Withdrawal Penalties

- One of the key penalties associated with early withdrawals from a Roth IRA is a 10% tax penalty on the amount withdrawn.

- This penalty is in addition to any regular income tax that may be due on the withdrawn amount.

- Early withdrawals are generally defined as those made before the account owner reaches age 59 ½.

Flexibility of Roth IRA Withdrawals

- Unlike traditional IRAs, Roth IRAs offer more flexibility when it comes to withdrawals.

- Contributions to a Roth IRA can typically be withdrawn at any time, tax and penalty-free, as they have already been taxed.

- Additionally, Roth IRA owners can withdraw their earnings tax-free if the account has been open for at least five years and they are over the age of 59 ½.

Estate Planning Benefits

Roth IRAs can play a crucial role in estate planning by allowing individuals to pass on wealth to their heirs in a tax-efficient manner. This type of retirement account offers unique advantages when it comes to inheritance and can be a valuable tool for building a legacy for future generations.

Using Roth IRA in Estate Planning

When incorporating a Roth IRA into an estate plan, individuals can designate beneficiaries who will inherit the account upon their passing. This allows for a seamless transfer of assets to loved ones, avoiding lengthy probate processes and potential estate taxes.

- Roth IRAs do not have required minimum distributions (RMDs) during the original account holder’s lifetime, allowing the account to continue growing tax-free for beneficiaries.

- Beneficiaries have the option to inherit the Roth IRA and continue its tax-free growth over their lifetime, providing a valuable source of income.

Inheritance Options for Beneficiaries

Beneficiaries of a Roth IRA have the flexibility to choose how they receive the inherited funds, based on their individual financial needs and goals. This includes options such as taking a lump-sum distribution, setting up a stretch IRA, or converting the inherited Roth IRA into their own account.

Roth IRAs offer the potential for tax-free withdrawals for beneficiaries, providing a significant advantage over traditional IRAs or 401(k) accounts.

Advantages of Passing on Wealth with Roth IRAs

Passing on wealth through a Roth IRA allows individuals to leave a tax-free inheritance to their heirs, creating a lasting financial legacy. This can help beneficiaries secure their financial future and achieve their own retirement goals without the burden of additional taxes on the inherited assets.

- Roth IRAs provide a tax-efficient way to transfer wealth, as beneficiaries can receive distributions free from income tax if certain conditions are met.

- By leveraging the benefits of a Roth IRA in estate planning, individuals can ensure that their loved ones receive the maximum value from their inheritance.