Yo, diving into the world of Evaluating insurance needs, we’re about to break down all the crucial factors and types of coverage you need to know. Get ready to level up your insurance game, fam!

From understanding different life stages to assessing risk tolerance, we got you covered with all the deets you need to navigate the insurance maze like a pro.

Factors to Consider

When evaluating insurance needs, it is crucial to take into account various factors that can significantly impact the type and amount of coverage required. Factors such as different life stages, income levels, and family size play a vital role in determining the insurance needs of an individual or a family.

Life Stages

Life stages, such as getting married, having children, or nearing retirement, can greatly influence insurance needs. For instance, a young couple with children may require more life insurance coverage compared to a single individual without dependents. As individuals progress through different life stages, their insurance needs evolve accordingly.

Income Levels

Income levels directly impact the type and amount of insurance required. Higher income earners may need more extensive coverage to protect their assets and provide financial security for their loved ones. On the other hand, individuals with lower income levels may opt for more affordable insurance options that still offer adequate protection.

Family Size

The size of one’s family also plays a crucial role in evaluating insurance needs. A larger family with more dependents may require additional coverage to ensure that all family members are financially protected in the event of unforeseen circumstances. Family size can influence the amount of life insurance, health insurance, and other types of coverage needed to safeguard the well-being of loved ones.

Types of Insurance Coverage

Insurance coverage comes in various forms to meet different needs. Let’s explore the differences between term life insurance and whole life insurance, the importance of health insurance for medical expenses, and the benefits of disability insurance for income protection.

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the policyholder and includes a cash value component that grows over time. While term life insurance is more affordable and straightforward, whole life insurance offers lifelong protection and an investment component.

Significance of Health Insurance

Health insurance plays a crucial role in covering medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. Without health insurance, individuals may face significant financial burdens when unexpected medical issues arise. Having health insurance ensures access to quality healthcare services without worrying about the high costs associated with treatments.

Benefits of Disability Insurance

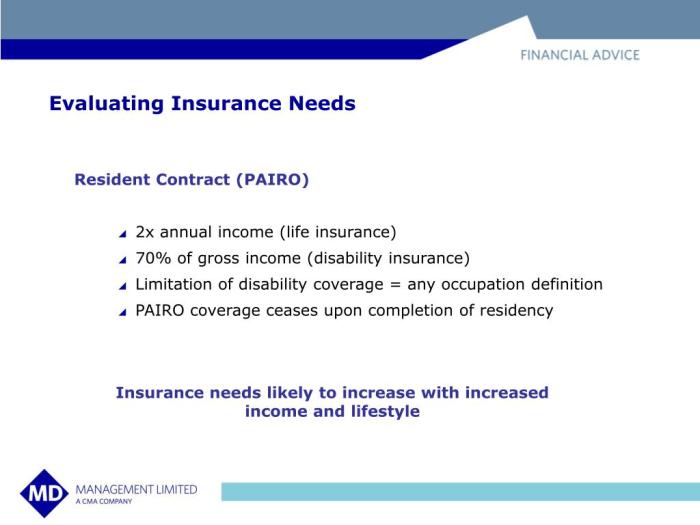

Disability insurance provides income protection in case an individual becomes unable to work due to a disability or injury. It replaces a portion of the policyholder’s income, helping them cover essential expenses such as mortgage payments, bills, and daily living costs. Disability insurance offers peace of mind by ensuring financial stability during challenging times when the ability to work is affected.

Evaluating Property Insurance

When it comes to protecting your home, property insurance plays a crucial role in safeguarding against unforeseen events such as natural disasters, theft, or accidents. It provides financial protection to cover the cost of repairs or replacements in case of damage or loss.

Importance of Home Insurance

- Home insurance provides coverage for your dwelling, personal belongings, and liability protection in case someone is injured on your property.

- It offers peace of mind knowing that you are financially protected in case of unexpected events that could result in significant financial loss.

- Having home insurance is often a requirement by mortgage lenders to protect their investment in your property.

Factors Affecting Property Insurance Premiums

- The location of your home, including proximity to fire stations, crime rates, and natural disaster risk, can impact the cost of premiums.

- The age and condition of your home, as well as the materials used in construction, can affect insurance costs.

- Your claims history, credit score, and the coverage limits you choose also play a role in determining the price of property insurance.

Additional Coverage Options for Property Insurance

- Flood insurance provides protection against water damage caused by flooding, which is typically not covered under a standard home insurance policy.

- Earthquake insurance offers coverage for damage caused by earthquakes, which is also usually not included in a standard policy.

- Personal property insurance can provide additional coverage for valuable items such as jewelry, art, or electronics that may exceed standard policy limits.

Assessing Risk Tolerance

When it comes to evaluating insurance needs, understanding your risk tolerance plays a crucial role in making informed decisions. Risk tolerance refers to your willingness to take on risk in exchange for potential rewards or benefits. This factor heavily influences the type and amount of insurance coverage you choose to purchase.

Strategies for Balancing Coverage and Premiums

Assessing your risk tolerance can help you strike a balance between coverage and premiums. Here are some strategies to consider:

- Conduct a thorough risk assessment: Identify potential risks and evaluate the likelihood of them occurring. This will help you prioritize the areas where you need more coverage.

- Consider your financial situation: Determine how much you can afford to pay in premiums and how much financial risk you are willing to take on in the event of a loss.

- Review your current coverage: Evaluate your existing insurance policies to ensure they align with your risk tolerance. You may need to adjust your coverage levels based on changing circumstances.

Impact of Risk Assessment on Insurance Needs

Understanding your risk tolerance can have a direct impact on your insurance needs. For example:

- High risk tolerance: If you have a high risk tolerance, you may opt for higher deductibles and lower coverage limits to reduce your premiums. However, you should be prepared to absorb more financial risk in the event of a claim.

- Low risk tolerance: On the other hand, if you have a low risk tolerance, you may choose comprehensive coverage with lower deductibles to ensure greater financial protection, even if it means paying higher premiums.

- Changing circumstances: Your risk tolerance may evolve over time due to changes in your financial situation, family status, or other factors. It’s essential to regularly reassess your risk tolerance and adjust your insurance coverage accordingly.