Diving deep into the world of Health Savings Accounts (HSAs), get ready for a wild ride filled with financial wisdom and savvy tips that will have you feeling like a money guru in no time.

Get ready to explore the ins and outs of HSAs, from contribution limits to tax advantages, in a way that’s informative and downright cool.

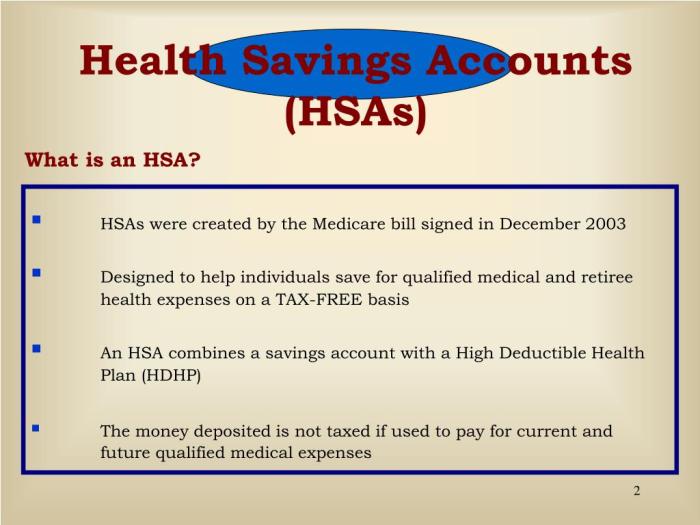

Introduction to Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a type of savings account that allows individuals to save money for medical expenses on a tax-advantaged basis. These accounts are designed to work in conjunction with a high-deductible health plan (HDHP), where individuals can use the funds in their HSA to pay for qualified medical expenses.

Benefits of Having an HSA

- Tax advantages: Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Control over healthcare costs: With an HSA, individuals have the flexibility to pay for medical expenses as needed, without worrying about copays or deductibles.

- Unused funds roll over: Unlike flexible spending accounts (FSAs), funds in an HSA roll over from year to year, allowing for long-term savings.

Eligibility Criteria for Opening an HSA

To be eligible to open an HSA, individuals must meet the following criteria:

- Be covered by a high-deductible health plan (HDHP)

- Not be enrolled in Medicare

- Not be claimed as a dependent on someone else’s tax return

- Not have any other health coverage that is not an HDHP

Contributions and Limits

Health Savings Accounts (HSAs) have specific contribution limits set by the IRS each year. For 2021, the maximum contribution limits are $3,600 for individuals and $7,200 for families. These limits are subject to change annually due to inflation adjustments.

Contributions to an HSA are tax-deductible, meaning that the money you contribute to your HSA is not subject to federal income tax. This provides a significant tax advantage for individuals looking to save for medical expenses.

Penalties for Exceeding Contribution Limits

If you exceed the contribution limits set by the IRS for your HSA, you may be subject to penalties. Any excess contributions are considered taxable income and are subject to a 6% excise tax. It’s important to track your contributions throughout the year to ensure you do not exceed the set limits.

Qualified Medical Expenses

When it comes to using your Health Savings Account (HSA) funds, it’s important to know what expenses qualify for reimbursement. Here are some examples of qualified medical expenses that can be paid for using HSA funds:

Examples of Qualified Medical Expenses

- Doctor’s visits

- Prescription medications

- Hospital fees

- Dental treatments

- Vision care (glasses, contact lenses)

- Mental health services

- Physical therapy

- Medical equipment (crutches, wheelchairs)

Eligible vs. Ineligible Expenses

- Eligible expenses are those that are primarily for the diagnosis, cure, mitigation, treatment, or prevention of disease or for treatments affecting any structure or function of the body.

- Ineligible expenses include cosmetic procedures, general health items (vitamins, supplements), and non-prescription drugs (unless prescribed).

Determining Expense Eligibility

For an expense to qualify for HSA reimbursement, it must be considered a qualified medical expense by the IRS. The IRS provides Publication 502, Medical and Dental Expenses, as a reference guide to determine if an expense is eligible for reimbursement.

Investment Opportunities

Investment opportunities within an HSA can provide a way to potentially grow your savings over the long term. By strategically investing your HSA funds, you can take advantage of market growth and maximize your returns.

Types of Investment Options

When it comes to investing within an HSA, there are typically a variety of options available such as mutual funds, stocks, bonds, and more. These options allow you to diversify your portfolio and potentially increase your savings over time.

Potential for Growth and Long-Term Savings

Investing your HSA funds can offer the potential for significant growth over the long term. By carefully selecting investments and staying informed about market trends, you can work towards maximizing your returns and building a substantial nest egg for future healthcare expenses.

Strategies for Maximizing Investment Returns

To maximize investment returns within an HSA, consider factors such as your risk tolerance, investment goals, and time horizon. Diversifying your portfolio, regularly reviewing and adjusting your investments, and seeking guidance from financial advisors can all help you make informed decisions and optimize your returns.

Tax Implications

When it comes to Health Savings Accounts (HSAs), there are several tax advantages that account holders can benefit from. These tax advantages can have a significant impact on overall savings and financial planning.

Tax Advantages of Having an HSA

- Contributions to an HSA are tax-deductible: The money you contribute to your HSA is tax-deductible, meaning you can reduce your taxable income by the amount you contribute.

- Earnings grow tax-free: Any interest or investment gains on the funds in your HSA are not subject to federal income tax, allowing your savings to grow faster over time.

- Withdrawals for qualified medical expenses are tax-free: As long as you use the funds in your HSA for qualified medical expenses, you can withdraw the money tax-free, making it a tax-efficient way to pay for healthcare costs.

Taxation on Withdrawals

- If you withdraw funds from your HSA for non-qualified expenses before age 65, you will be subject to income tax on the amount withdrawn, as well as a 20% penalty. However, after age 65, you can withdraw funds for any reason without penalty, although you will still need to pay income tax on non-qualified withdrawals.

Impact on Savings and Financial Planning

- By taking advantage of the tax benefits of an HSA, you can potentially save on taxes while also building a fund for future healthcare expenses. This can help you better plan for medical costs in retirement and create a tax-efficient strategy for managing healthcare expenses.

Employer Contributions

Employer contributions to an employee’s Health Savings Account (HSA) are additional funds that the employer deposits into the employee’s HSA account. These contributions can be a valuable benefit that helps employees save for medical expenses while enjoying potential tax benefits.

Advantages of Employer Contributions for Employees

- Boost Savings: Employer contributions increase the total amount of money in the HSA, allowing employees to save more for future medical costs.

- Tax Benefits: Contributions made by the employer are typically not subject to federal income tax, providing a tax advantage to employees.

- Financial Security: With additional funds from the employer, employees have a safety net for unexpected medical expenses.

Maximizing Employer Contributions to HSA

- Contribute Yourself: To maximize employer contributions, ensure that you are contributing the maximum allowed amount to your HSA.

- Know the Limits: Understand the employer’s contribution policy and take full advantage of any matching or additional contributions they offer.

- Communicate: Talk to your employer’s HR department to clarify any questions you have about HSA contributions and ensure you are maximizing this benefit.