Diving into the realm of economic cycles, this intro sets the stage for a wild ride through the ups and downs of economies, with a fresh and funky vibe that’ll keep you hooked from start to finish.

Get ready to groove through the twists and turns of economic cycles, from the high-flying peaks to the rock-bottom troughs.

Definition of Economic Cycles

Economic cycles refer to the recurring patterns of expansion and contraction in an economy over time. These cycles impact various aspects of an economy, including employment, production, investment, and overall economic growth.

Phases of Economic Cycles

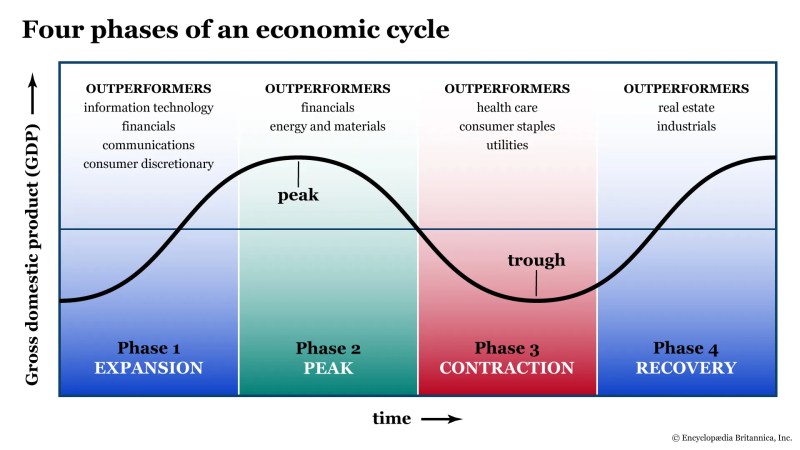

- Expansion: During this phase, the economy is growing, characterized by increased consumer spending, business investments, and overall economic activity.

- Peak: The peak marks the highest point of economic growth in a cycle, where the economy is at its strongest before entering a downturn.

- Contraction: Also known as a recession, this phase involves a decline in economic activity, leading to reduced consumer spending, layoffs, and lower production levels.

- Trough: The trough is the lowest point of the economic cycle, where the economy hits bottom before starting to recover.

Historical Examples of Economic Cycles

Throughout history, various economic cycles have had significant impacts on different industries. One notable example is the Great Depression in the 1930s, where the global economy experienced a severe contraction, leading to high unemployment rates and widespread financial hardship. Another example is the Dot-Com Bubble in the late 1990s, which saw a rapid expansion in the technology sector followed by a sharp contraction, resulting in many companies going out of business.

Factors Influencing Economic Cycles

Consumer spending, business investments, government policies, international trade, technological advancements, and natural disasters all play crucial roles in shaping economic cycles.

Consumer Spending

Consumer spending, which accounts for a significant portion of economic activity, can drive economic growth during expansionary periods and lead to downturns during contractions. When consumers are confident and have disposable income, they tend to spend more, boosting overall economic activity.

Business Investments

Business investments, such as capital expenditures and expansion projects, can stimulate economic growth by creating jobs, increasing productivity, and driving innovation. However, during economic downturns, businesses may cut back on investments, leading to decreased economic activity.

Government Policies

Government policies, including fiscal and monetary measures, can have a profound impact on economic cycles. For example, expansionary fiscal policies like increased government spending or tax cuts can stimulate economic growth, while contractionary policies can help cool down an overheated economy.

International Trade

International trade plays a vital role in economic cycles, as exports and imports can affect a country’s economic performance. Changes in trade policies, tariffs, and global demand can influence the balance of trade, impacting economic growth.

Technological Advancements

Technological advancements can drive economic cycles by spurring innovation, increasing efficiency, and creating new industries. The adoption of new technologies can lead to economic expansion, while disruptions in technology can cause economic downturns.

Natural Disasters

Natural disasters, such as hurricanes, earthquakes, or pandemics, can have devastating effects on economic cycles. These events can disrupt supply chains, destroy infrastructure, and lead to economic losses, impacting both short-term and long-term economic performance.

Understanding Leading Economic Indicators

Leading economic indicators are statistical data points that are used to predict the direction of an economy. These indicators are important tools for analysts and policymakers as they provide insights into the future economic conditions.

Examples of Leading Economic Indicators

- Consumer Confidence: This indicator measures the sentiment of consumers towards the economy. High consumer confidence usually indicates strong economic growth.

- Housing Starts: The number of new residential construction projects started in a given period. Rising housing starts can signify a growing economy.

- Stock Market Performance: The performance of major stock indices can be a leading indicator of economic health. A rising stock market is often associated with positive economic conditions.

Analysts use leading economic indicators to forecast future economic conditions by analyzing trends and patterns in these data points. By understanding how these indicators behave before the general economy shifts, analysts can make informed predictions about the future direction of the economy.

Impact of Monetary and Fiscal Policies on Economic Cycles

Monetary and fiscal policies play a crucial role in shaping economic cycles by influencing key factors like interest rates, money supply, government spending, and taxation.

Monetary Policies

Monetary policies, implemented by central banks, involve actions related to interest rates and money supply. Changes in interest rates can impact borrowing costs for businesses and individuals, affecting spending and investment decisions. Additionally, adjustments in the money supply can influence inflation levels and overall economic activity.

Fiscal Policies

Fiscal policies, on the other hand, are determined by governments through decisions on spending and taxation. Increased government spending can stimulate economic growth by boosting demand for goods and services, while changes in taxation can affect disposable income and consumer spending patterns. Both these factors can have significant effects on economic cycles.

Effectiveness of Policy Measures

The effectiveness of monetary and fiscal policies in managing economic fluctuations depends on various factors, including the current state of the economy, the timing of policy interventions, and the coordination between different policy tools. For instance, during a recession, lowering interest rates and increasing government spending can help stimulate economic activity. However, the success of these measures also relies on how quickly they are implemented and their overall impact on consumer and business confidence.

Business Strategies for Different Economic Phases

In the ever-changing landscape of economic cycles, businesses must adapt to survive and thrive. Let’s delve into the strategies that businesses can adopt during different phases of economic cycles.

Strategies for Economic Downturns

During economic downturns, businesses can implement the following strategies to weather the storm:

- Focus on cost-cutting measures such as reducing unnecessary expenses and renegotiating contracts.

- Diversify product offerings or target new markets to offset declining sales in current markets.

- Invest in marketing and promotions to maintain brand visibility and attract customers despite economic challenges.

Strategies for Economic Expansions

When the economy is booming, businesses can capitalize on the following strategies to maximize growth:

- Expand operations and invest in new technologies or equipment to meet increased demand.

- Raise prices strategically to maximize profits without alienating customers.

- Focus on customer retention and loyalty programs to ensure long-term success even after the expansion phase ends.

Examples of Successful Business Strategies

During the 2008 financial crisis, companies like Apple and Amazon thrived by innovating and launching new products to meet changing consumer needs. They focused on customer-centric strategies and invested in research and development to stay ahead of the curve. Similarly, during economic expansions, companies like Starbucks and Nike expanded globally and invested in marketing to capitalize on the growing market opportunities.