With Understanding market cycles at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Market cycles are like the heartbeat of the financial world, pulsating with ups and downs that shape investing strategies and opportunities. From the roaring highs to the crushing lows, understanding these cycles is key to navigating the unpredictable terrain of the market.

Overview of Market Cycles

Market cycles refer to the recurring patterns of growth and decline in financial markets. These cycles are driven by a combination of factors including investor sentiment, economic indicators, and market trends. Understanding market cycles is essential for investors to make informed decisions and manage risk effectively.

Phases of a Market Cycle

Market cycles typically consist of four main phases:

- Expansion: During this phase, the economy is growing, and stock prices are rising. Investor confidence is high, and there is optimism about the future.

- Peak: The peak marks the end of the expansion phase. Stock prices reach their highest point, and investor sentiment is extremely bullish.

- Contraction: In this phase, economic growth slows down, leading to a decline in stock prices. Investor confidence wanes, and there is a sense of caution in the market.

- Trough: The trough is the lowest point in the market cycle. Stock prices bottom out, and investor sentiment is at its lowest. However, it is also a period of opportunity for savvy investors to buy low.

Examples of Historical Market Cycles

One of the most famous examples of a market cycle is the Dot-Com Bubble of the late 1990s and early 2000s. During this period, internet-related stocks experienced a massive surge in value, only to crash spectacularly when the bubble burst. This cycle serves as a cautionary tale about the dangers of speculative investing and the importance of understanding market cycles.

Factors Influencing Market Cycles

Investors, economists, and analysts are always on the lookout for factors that can influence market cycles. These factors can range from economic indicators to geopolitical events, all of which play a crucial role in shaping the direction of financial markets.

Economic Factors Driving Market Cycles

- The state of the economy: Economic growth, inflation rates, and employment numbers can all impact market cycles. A strong economy usually leads to bullish markets, while a weak economy can result in bearish trends.

- Interest rates: Central banks’ decisions on interest rates can have a significant impact on market cycles. Lower interest rates can stimulate economic activity and lead to stock market rallies, while higher rates can dampen investor sentiment.

- Corporate earnings: The profitability of companies is a key driver of market cycles. Positive earnings reports can boost stock prices, while disappointing results can lead to market corrections.

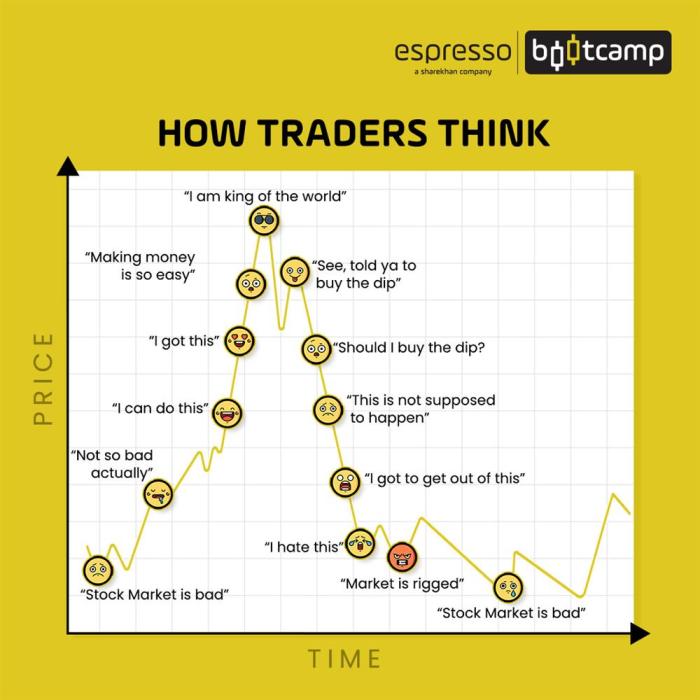

Investor Behavior and Market Cycles

- Herd mentality: Investor behavior often follows the crowd, leading to market bubbles or crashes. Fear and greed can drive extreme market movements, causing volatility in asset prices.

- Risk appetite: Investors’ willingness to take on risk can impact market cycles. During times of uncertainty, risk-averse behavior can lead to market downturns, while periods of optimism can fuel market rallies.

- Market sentiment: The overall sentiment of investors, whether bullish or bearish, can influence market cycles. Positive sentiment can create a self-fulfilling prophecy of rising prices, while negative sentiment can trigger sell-offs.

Geopolitical Events Impacting Market Cycles

- Trade tensions: Trade disputes between countries can disrupt global markets and lead to increased volatility. Tariffs, sanctions, and trade agreements can all impact market cycles, especially in sectors heavily reliant on international trade.

- Political instability: Political events such as elections, changes in government leadership, or geopolitical conflicts can create uncertainty in financial markets. Investors may react by adjusting their portfolios, leading to market fluctuations.

- Natural disasters: Environmental events like hurricanes, earthquakes, or pandemics can have far-reaching effects on market cycles. Supply chain disruptions, insurance claims, and rebuilding efforts can all impact various sectors of the economy.

Types of Market Cycles

Market cycles can be broadly categorized into different types based on their duration and impact on various industries. Understanding these cycles is crucial for investors and businesses to make informed decisions.

Business Cycles

Business cycles refer to the fluctuations in economic activity over a period of time. These cycles typically consist of four phases – expansion, peak, contraction, and trough. During the expansion phase, the economy grows, leading to increased consumer spending and business investments. The peak marks the highest point of economic activity before a downturn begins. The contraction phase involves a decrease in economic activity, leading to lower production and higher unemployment rates. Finally, the trough is the lowest point of the cycle before the economy starts to recover.

Secular Cycles

Secular cycles are long-term trends that can last for several decades. These cycles are driven by structural changes in the economy, such as technological advancements, demographic shifts, or regulatory changes. Secular cycles can have a profound impact on industries, leading to the rise and fall of certain sectors over time. For example, the shift from the industrial age to the digital age has created new opportunities in technology and e-commerce while diminishing the demand for traditional manufacturing industries.

Short-term vs. Long-term Market Cycles

Short-term market cycles typically last for a few months to a few years and are influenced by factors such as consumer sentiment, interest rates, and geopolitical events. These cycles can create opportunities for investors to capitalize on short-term fluctuations in the market. On the other hand, long-term market cycles can span decades and are shaped by structural changes in the economy. Understanding the differences between short-term and long-term cycles is essential for developing a well-rounded investment strategy.

Recognizing Market Cycle Phases

Understanding market cycle phases is crucial for making informed investment decisions. By recognizing the different stages of a market cycle, investors can adjust their strategies accordingly to maximize returns and minimize risks.

Key Indicators for Identifying Market Cycle Phases

- Market Sentiment: Monitor the overall mood and attitude of investors towards the market.

- Price Trends: Analyze the direction and momentum of asset prices to determine if they are in an uptrend or downtrend.

- Volume: Look at trading volume to gauge the level of participation and interest in the market.

- Economic Indicators: Pay attention to key economic indicators that can provide insights into the health of the economy and its impact on the market.

Importance of Understanding Market Cycle Phases for Investment Decisions

Recognizing market cycle phases allows investors to anticipate potential shifts in the market and adjust their portfolios accordingly. By being aware of where the market is in the cycle, investors can make more informed decisions about when to buy, sell, or hold their investments.

Strategies for Adapting Investment Approaches Based on Market Cycle Phases

- Buy Low, Sell High: During the early stages of a bull market, consider increasing exposure to equities. In contrast, during the late stages of a bull market, it may be prudent to take profits and rebalance your portfolio.

- Diversification: Maintain a diversified portfolio to reduce risk exposure across different asset classes and sectors, especially during periods of market uncertainty.

- Active Monitoring: Continuously monitor market indicators and economic data to stay informed about potential changes in market conditions.

- Risk Management: Implement risk management strategies, such as setting stop-loss orders and position sizing, to protect your investments during volatile market phases.

Impact of Market Cycles on Investments

Investing in different asset classes like stocks, bonds, and real estate can be greatly influenced by market cycles. Understanding these cycles is crucial for making informed investment decisions.

Influence on Different Asset Classes

Market cycles can impact various asset classes differently. For example, during a bull market, stocks tend to perform well as investor confidence is high, while bonds may underperform due to lower demand for fixed-income securities. On the other hand, in a bear market, bonds are considered safer investments, providing stability when stock prices are falling. Real estate can also be affected by market cycles, with property values fluctuating based on economic conditions and investor sentiment.

Risks Associated with Different Market Cycle Phases

Investing during different market cycle phases comes with its own set of risks. For instance, during a market peak, there is a risk of a sudden downturn, leading to potential losses for investors who bought in at the top. In contrast, during a market trough, there is an opportunity for significant gains as prices are low, but the risk of further decline exists. It’s essential for investors to assess these risks and adjust their strategies accordingly.

Successful Investment Strategies for Different Market Cycle Conditions

Tailoring investment strategies to specific market cycle conditions can help investors navigate the ups and downs of the market. For example, during a recession, focusing on defensive stocks or sectors that are less sensitive to economic fluctuations can provide stability. In a growth market, growth stocks or industries poised for expansion may offer higher returns. Diversification across asset classes can also help mitigate risks associated with market volatility.