Understanding stock options sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Stock options are like a hidden treasure chest in the world of investing, waiting to be discovered and utilized to their full potential. As we delve deeper into the intricacies of stock options, a whole new world of possibilities opens up before us.

Overview of Stock Options

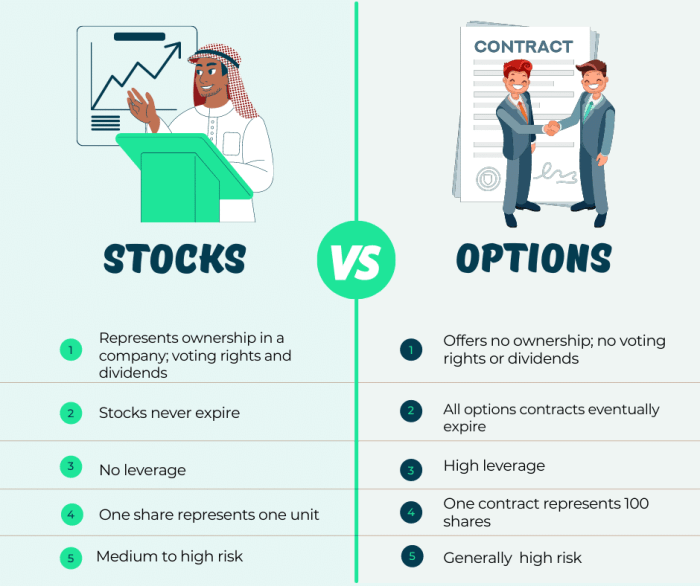

Stock options are financial instruments that give the holder the right, but not the obligation, to buy or sell a specific amount of stock at a fixed price within a certain period of time. They are commonly used in investing as a way to potentially profit from changes in a stock’s price without actually owning the stock.

Types of Stock Options

- Call Options: These give the holder the right to buy a specific amount of stock at a predetermined price before a certain date.

- Put Options: These give the holder the right to sell a specific amount of stock at a predetermined price before a certain date.

Purpose of Stock Options in Investing

Stock options can serve various purposes in investing, including:

- Speculation: Investors can use options to speculate on the price movement of a stock without actually owning it.

- Hedging: Options can be used to protect against potential losses in a stock position.

- Income Generation: Selling options can generate income for investors through premiums.

How Stock Options Work

Stock options are a type of financial instrument that give individuals the right to buy or sell a specific amount of a company’s stock at a set price within a certain time frame. This allows investors to potentially profit from changes in the stock price without actually owning the stock itself.

Granting Stock Options to Employees

When a company grants stock options to employees, it is essentially offering them the opportunity to purchase shares of the company’s stock at a predetermined price, known as the exercise price or strike price. This is often done as a way to incentivize employees to work towards the company’s success, as they will benefit from any increase in the stock price.

- Employees typically receive stock options as part of their compensation package, with the number of options granted based on factors such as job performance and tenure.

- The vesting period is the length of time an employee must wait before they can exercise their stock options. This is designed to encourage employees to stay with the company for a certain period.

- Once the options are vested, employees can choose to exercise them by purchasing the stock at the predetermined price, and then sell the stock at the current market price to realize a profit.

Terms and Conditions of Stock Options

Stock options come with specific terms and conditions that Artikel how they can be exercised and under what circumstances. These terms may include restrictions on selling the stock, expiration dates for the options, and any tax implications associated with exercising the options.

It’s important for employees to carefully review the terms of their stock options to fully understand how they work and the potential benefits they can provide.

Benefits of Stock Options

Stock options are a valuable component of a compensation package for employees, providing several advantages for both the company and the individual.

Aligning Employee Interests with Company Performance

- Stock options motivate employees to work towards the company’s success, as they directly benefit from the increase in stock value.

- Employees are more likely to focus on long-term goals and performance, leading to increased productivity and loyalty.

- By tying compensation to the company’s performance, employees are encouraged to make decisions that benefit the organization as a whole.

Providing Leverage for Investors

- Stock options allow investors to control a larger amount of stock with a smaller initial investment, increasing the potential for profit.

- Investors can benefit from the leverage provided by stock options, amplifying their returns if the stock price rises.

- Stock options provide a way for investors to participate in the company’s growth without purchasing the stock outright, reducing the risk associated with direct stock ownership.

Risks Associated with Stock Options

When trading stock options, investors need to be aware of the potential risks involved. These risks can impact the value of the options and the overall outcome of the investment. Understanding these risks is crucial for making informed decisions in the stock market.

Market Volatility

Market volatility plays a significant role in the world of stock options. When the market is highly volatile, the value of options can fluctuate rapidly, leading to increased risk for investors. Sudden price movements can result in significant losses, especially if the market moves against the investor’s position. It is essential to closely monitor market conditions and adjust strategies accordingly to manage this risk effectively.

- High volatility can lead to higher option premiums, increasing the cost of trading options.

- Low volatility can decrease the value of options, making it challenging to profit from trades.

- Unexpected events or economic news can trigger volatility, impacting option prices.

Timing and Market Conditions

The timing of trades and prevailing market conditions can have a direct impact on the value of stock options. Factors such as interest rates, economic indicators, and geopolitical events can influence market sentiment and drive changes in option prices. Investors must consider these factors when trading options to mitigate risks and maximize potential returns.

It is crucial to assess the overall market environment and make informed decisions based on current conditions to navigate risks effectively.

- Changes in market trends can affect the profitability of options trades.

- Timing entry and exit points is essential to capitalize on price movements and minimize losses.

- Market conditions can vary across different sectors and industries, requiring tailored strategies for successful options trading.

Strategies for Trading Stock Options

When it comes to trading stock options, there are several common strategies that investors can utilize to maximize their gains and minimize their risks. Understanding these strategies is crucial for making informed decisions in the market.

Covered Call Strategy

The covered call strategy involves selling a call option on a stock that an investor already owns. This strategy allows the investor to generate additional income from the premiums received from selling the call option. However, it limits the potential upside gains if the stock price rises significantly.

Protective Put Strategy

The protective put strategy involves buying a put option on a stock that an investor owns. This strategy acts as insurance against a potential decline in the stock price. If the stock price falls, the put option can be exercised to sell the stock at a predetermined price, limiting the losses.

Straddle Strategy

The straddle strategy involves buying both a call option and a put option on the same stock with the same strike price and expiration date. This strategy is used when investors expect significant price volatility but are unsure about the direction of the price movement. If the stock price moves significantly in either direction, one of the options will profit while the other will expire worthless.

Option Pricing Models

Option pricing models, such as the Black-Scholes model, play a crucial role in determining the fair value of options. These models take into account factors such as the underlying stock price, strike price, time to expiration, interest rates, and volatility. Investors use these models to calculate the theoretical price of options and make informed trading decisions.